Customs Calculator

Instructions

This tool will estimate the total cost of importing goods into the UK. The rules for this changed on 1st January 2020 due to Brexit but there was also a general change in the way duty is collected made on the same date. Some costs now have to be collected at the point of sale rather than at the border depending on the total order value.

The calculator is to find an estimate and the rates are subject to change. It is intended for informational purposes only and should not be relied upon for any official figures.

Calculator

Commodity Codes and Duty Rates

When importing goods they are classified using commodity codes (there are thousands of these) and different codes have different duty rates. Some items are zero rated (referred to as ‘liberalised’) and for others it may vary up to around 20% but this can be much higher for some foods and other goods.

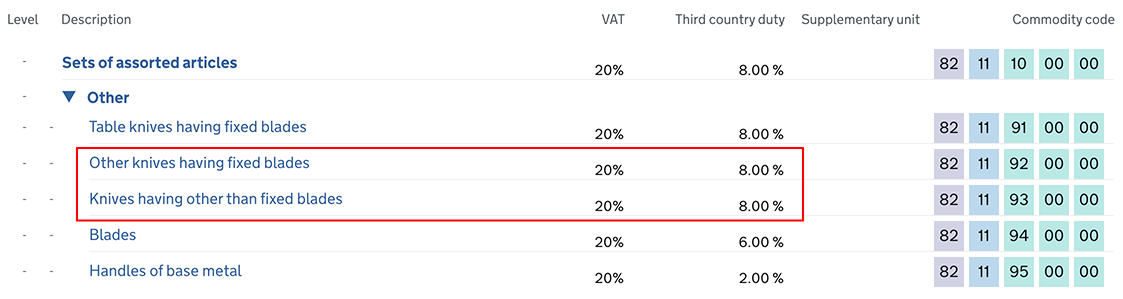

If you do not know the duty rate for the item you are interested in buying you can use the tarrif lookup tool to find the rate and enter it into the calculator. Find the correct code and then look for the ‘Third country duty’ value as in the image below. This can be quite difficult in some cases, there are for example 103 entries that mention ‘sewing thread’ at the time of writing as the options are very exhaustive.

Some common rates can be set in the box by clicking the links to the side of the box (knives etc.).